Payroll Processing done right

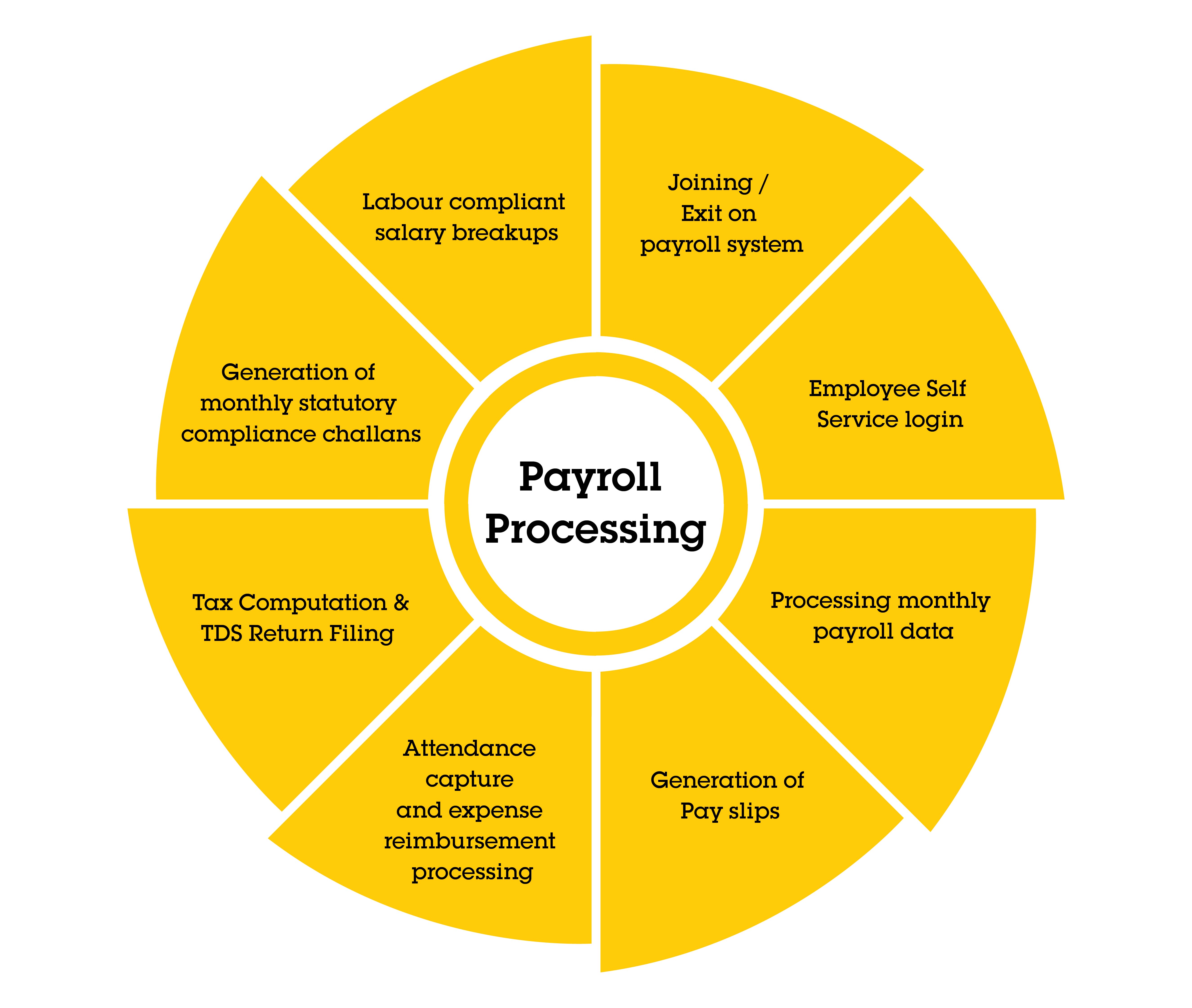

To simplify, Payroll processing is a system of managing the salaries of the employees issued by its company. Although it seems easy, there are a lot more intricacies that go beyond the regular Salary calculations. Salary deductions, keeping track of employee’s working hours for a dedicated period, Tax calculations, managing benefits, wage distribution, etc. are some of the steps involved.

The smooth functioning of an organization demands a proficient team. A dedicated in-house team can add an existing nuisance to the management. Therefore, most of the successful companies rely on outsourcing their HR functions to a professional company. Talisman HR Solutions is one such entity trusted by numerous prominent names for Payroll Processing.

Talisman HR also provides one-time solution to simplify and streamline Payroll department by conducting Payroll and compliance audit. Often for no fault of the promoters, wrong salary breakup can increase liability of companies. Talisman HR provides a GAP analysis which shows where a company should be and where they are currently.

Why Outsource Payroll Processing services to Talisman HR Solutions

- Talisman HR Solutions (THRS) will appoint a Single Point of Contact (SPOC) to co-ordinate with a SPOC of Client for all operational execution.

- Coordinate with client authorities all India to update the new joining/exit on the payroll system.

- Provide Employee Self Service login to all employees to access salary slips / TDS calculations etc.

- Process the Payroll Data on monthly basis.

- Offer the generated payroll data to the company for salary disbursement (Bank File) or upload the same directly on bank website as per client requirement

- Generate pay slips on monthly basis and publish on the HRMS platform.

- Employees can download using the Employee Self Service module.

- Collect modification data and other relevant inputs in an agreed format to facilitate updates on the system for effectively processing payroll and maintain the HRMS data accurate.

- TDS Return quarterly and TDS payment challan to be given to client monthly for payment.

- Monthly JV file along to be submitted to Finance Department (if applicable and needed by client).

- Generation and upload of monthly PF, ESIC, Professional Tax, MLWF challans on government websites and provide link to client for making the payment of the same.

- Tax computation done for all employees.

- Employees can declare their investments directly on the HRMS portal and download their Form 16 from the same.